The state of Automotive, Industrial & Medical Electronics Manufacturing

Over the past two decades, the global market for printed circuit boards has been shaped by the growth of and technological change in the electronics industry in general and, in particular, by end devices such as computers — from servers to desktops and notebooks — in addition to smartphones and tablets.

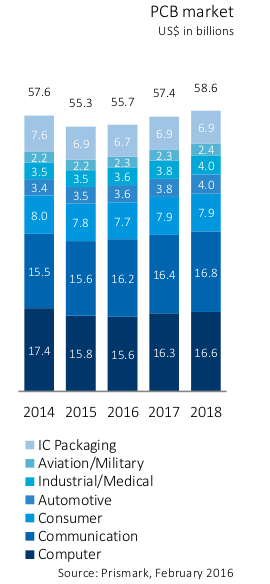

According to estimates in a November 2015 report by Prismark Partners LLC (Prismark Partners), worldwide demand for PCBs was approximately $56.4 billion in 2015, and worldwide PCB revenue is expected to increase at a rate of 2.0% in 2016. The latest report from IPC, confirms these numbers with the world market of PCBs reaching $58.6 billion in value in 2015. This represents a nominal decrease of 2.7 percent from 2014, but factoring out the effects of exchange rate fluctuations, the growth of PCB output was actually up 2.0 percent in real terms. Those results are mainly due to a weak demand in the computer segment and in consumer products, the former contracting by 10% in 2015.

According to estimates in a November 2015 report by Prismark Partners LLC (Prismark Partners), worldwide demand for PCBs was approximately $56.4 billion in 2015, and worldwide PCB revenue is expected to increase at a rate of 2.0% in 2016. The latest report from IPC, confirms these numbers with the world market of PCBs reaching $58.6 billion in value in 2015. This represents a nominal decrease of 2.7 percent from 2014, but factoring out the effects of exchange rate fluctuations, the growth of PCB output was actually up 2.0 percent in real terms. Those results are mainly due to a weak demand in the computer segment and in consumer products, the former contracting by 10% in 2015.

The technological development of high-end printed circuit boards and substrates will continue to be driven in the next several years by applications in the communication and computer areas. These segments will continue to influence the architecture of the electronic components they need, including semiconductors, and not only accelerate the already rapid technological development of substrates and printed circuit boards, but also drive the convergence of the technologies they use.

According to Moore’s law, the continuous miniaturization in the semiconductor industry will define the associated increase in power density — even if, in the future, it is no longer every two years but a longer interval instead. There will be a simultaneous reduction in semiconductor size and miniaturization in printed circuit boards and substrates, and thus continued growth in HDI and microvia technology. Furthermore, additional miniaturization potential will emerge through the combination of production processes and materials for high-end printed circuit boards with the processes and technologies from substrate production.

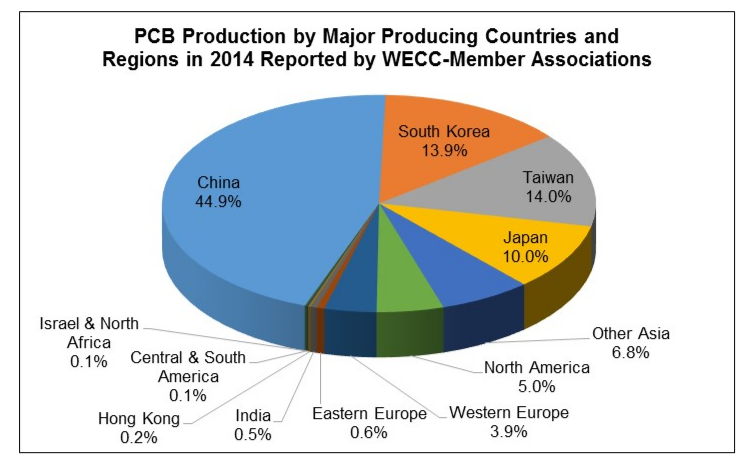

Of the worldwide demand for production in 2015, the Americas accounted for approximately 5% (approximately $3 billion), China accounted for approximately 47% (approximately $26.2 billion), and the rest of the world accounted for approximately 48% (approximately $27.3 billion), according to estimates by Prismark Partners. While various experts expect long-term growth to occur in all PCB technologies, they forecast more robust growth in the HDI, flexible and rigid-flex segments. This growth expectation stems from the increase in the number of applications that can utilize, and in many cases require, smaller, denser interconnects. The markets for mobile devices and automotive electronics are seen as high-growth segments. These markets, along with the growing demand for interconnected devices and wearable electronics, are expected to keep the PCB industry growing faster than the economy.

The PCB manufacturing business is highly fragmented. According to a 2015 report by NTI, a PCB industry research firm, there were approximately 2,400 PCB manufacturers worldwide at the end of the first half of 2015, with the top 20 companies representing approximately 45% of the global market (by revenue) in 2014. As a result of global economic trends, the number of PCB producers operating in China has increased significantly since 2000. This corresponds with a significant decline in the number of North American and European PCB producers during the same time period.

Another determining force in the production of electronics products is the worldwide electronics manufacturing services (EMS) which now accounts for almost 40 percent of all assembly according to a 2016 research from New Venture Research (NVR). While the rate of growth for outsourcing is slowing, it still represents the most desired manufacturing model for the assembly of electronics products available to OEM companies. The EMS industry declined approximately 1.7 percent in nominal terms in 2015 as a result of the slowing of sales for PCs (desktop and notebook).

Another determining force in the production of electronics products is the worldwide electronics manufacturing services (EMS) which now accounts for almost 40 percent of all assembly according to a 2016 research from New Venture Research (NVR). While the rate of growth for outsourcing is slowing, it still represents the most desired manufacturing model for the assembly of electronics products available to OEM companies. The EMS industry declined approximately 1.7 percent in nominal terms in 2015 as a result of the slowing of sales for PCs (desktop and notebook).

NVR estimates that total electronics assembly value was $1.3 trillion in 2015 and will grow to approximately $1.6 trillion in 2020 — a 4.0 percent compounded annual growth rate. Fueled by the demand for EMS services, NVR believes that the contract manufacturing industry will grow from $430 billion in 2015 to $580 billion in 2020 — approximately at a 6.2 percent CAGR.

Trends

The opportunities that arise from the intelligent combination of various technologies also mean new growth potential for the printed circuit board industry. Thus the assembly service market, which today is controlled exclusively by electronic manufacturing services and original device manufacturing companies, opens up for manufacturers of high-end printed circuit boards and substrates through embedding technologies, as does the packaging market currently dominated by the semiconductor industry.

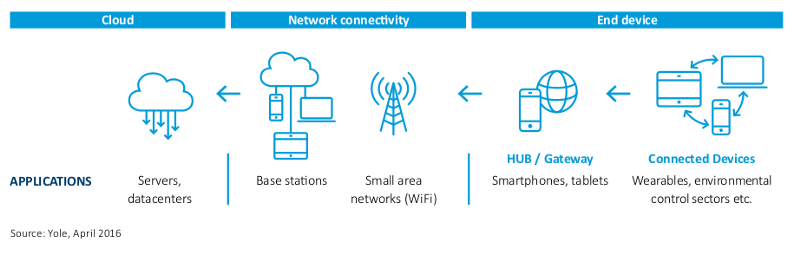

The world is becoming more digital. The driving forces are the available and nearly omnipresent possibilities for connection, the ever-declining costs of data transmission and sensors, and use of the internet to support communication between electronic devices. As such, society is poised at the start of the “Internet of Things” (IoT) — a logical technological development based on how internet-connected devices are used to improve the exchange of data, automate complex industrial processes, and generate valuable information. The potential of the “Internet of Things” as the “next big thing” is most often assessed based on the growth in devices connected through the internet. However, the latest studies by Yole forecast that the strongest areas of growth in connection with IoT will not be end devices such as wearables and sensors or smartphones and tablets, but rather the necessary infrastructure such as base stations for the transmission of data as well as powerful computers and data centers to process and store the rapidly increasing volume of data.

More about IoT in the Automobile Industry

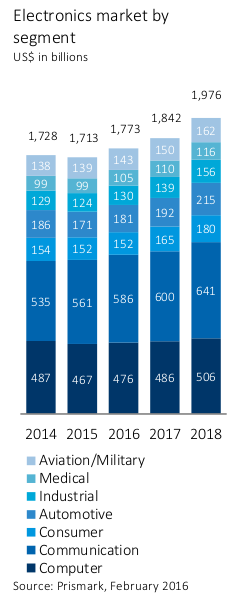

This development will significantly influence further growth of the entire electronics industry in all segments. Servers and storage media show the greatest growth potential in the computer segment, with average annual increases of 5.7% until 2018, end devices in the consumer segment at 5.8%, electronics for automobiles at 7.9%, industrial electronics at 8.0% and the market for medical electronics at 5.4%.

Automotive electronics: Above-average growth through new devices

The share of the automotive market in electronic systems declined in value in 2015 by 8.1% on a US$ basis. It is expected to grow by 7.9% annually until 2018 (source: Prismark, March 2016). Demand for printed circuit boards for automotive electronics is anticipated to grow by an annual average of 4.6% (source: Prismark, February 2016). Thus the growth rates for electronic systems for the automotive market as well as for printed circuit boards in this segment are significantly higher than the average overall figures for the global electronics industry.

In this segment, applications in the area of safety and information also drive the demand and the use of HDI and microvia printed circuit boards. The applications in which HDI and microvia printed circuit boards are now used extend from navigation, multimedia and infotainment systems to emergency calling and camera systems and electronic transmission control.

The concept of “autonomous driving” has sparked the development of central systems to collect the data and information from camera systems, radar and ultrasound sensors, analyze them, and ultimately control the relevant actuators for braking, stability and steering systems. These new central computers also need HDI technology because of the large volumes of data and the required data transfer speed.

Industrial Electronics: growth fueled by Industry 4.0

The industrial electronics systems market declined from 2014 to 2015 by 3.9%. In 2016, independent market analysts expect a growth rate of 4.8% (Source: Prismark, February 2016). The correlated growth in printed circuit boards for this segment is expected to about 3% for the same time period. (Source: Prismark, February 2016). The industrial electronics segment continues to be heavily influenced by applications in the areas measurement and control technology, power electronics, lighting systems as well as diagnostic instruments, RFID readers and also railway technology. In the future, M2M (machine-to-machine and machine-to-man) communication modules driven by Industry 4.0 activities will enable further growth in this segment.

Medical Electronics: Complexity drives growth in the sector

The global market for medical electronics systems had a value of US$ 99 billion in 2015 (source: Prismark, February 2016), representing stagnation year on year. The medical electronics market is characterized by a high level of complexity with regard to applications such as diagnostic and imaging devices, therapy applications and patient monitoring. Further application areas are surgical lighting, analytical instruments and molecular diagnostics. Prices for medical technology, devices and systems range from low two-digit US$ amounts for fitness trackers to several 100,000 US$ for a computer tomography system. Average annual growth of around 5.4% is expected until 2018.

Further reading: The state of auto cybersecurity: current vulnerabilities in connected vehicles

Process Monitoring in the Automotive Industry

This article was written by Radu Diaconescu, an electrical engineer by trade having earned an EPFL (Swiss Federal Institute of Technology Lausanne) Management of Technology masters and honed his skills while at Honeywell. He is currently managing Swie.io’s business development efforts and sits on the Board of Directors building the world’s next generation platform for agile manufacturing of electronics.

This article was written by Radu Diaconescu, an electrical engineer by trade having earned an EPFL (Swiss Federal Institute of Technology Lausanne) Management of Technology masters and honed his skills while at Honeywell. He is currently managing Swie.io’s business development efforts and sits on the Board of Directors building the world’s next generation platform for agile manufacturing of electronics.

Sorry, the comment form is closed at this time.

Pingback: The state of Automotive, Industrial & Medical Electronics Manufacturing | Premium apps reviews Blog and Programing