Asset subscribership: What can Industrial market learn from Automotive?

The year 2018 and beyond is poised to be an era of industrial. The industrial market comprises of process industries (oil and gas – up-, mid-, downstream, chemicals, power), discrete (automotive, A&D, electronics, etc.) and hybrids (pharma, F&B, etc.). Every market specified here is undergoing a disruption by digital. At Frost & Sullivan – we engage with large and mid-sized end-users to assess and continuously monitor the digital state of the industrial markets. Me personally having led many of these, can confidently tell you, that this is just the tip of the iceberg. Digital will see large waves of investments, as industries brace and prepare to sustain performance in times of uncertainty.

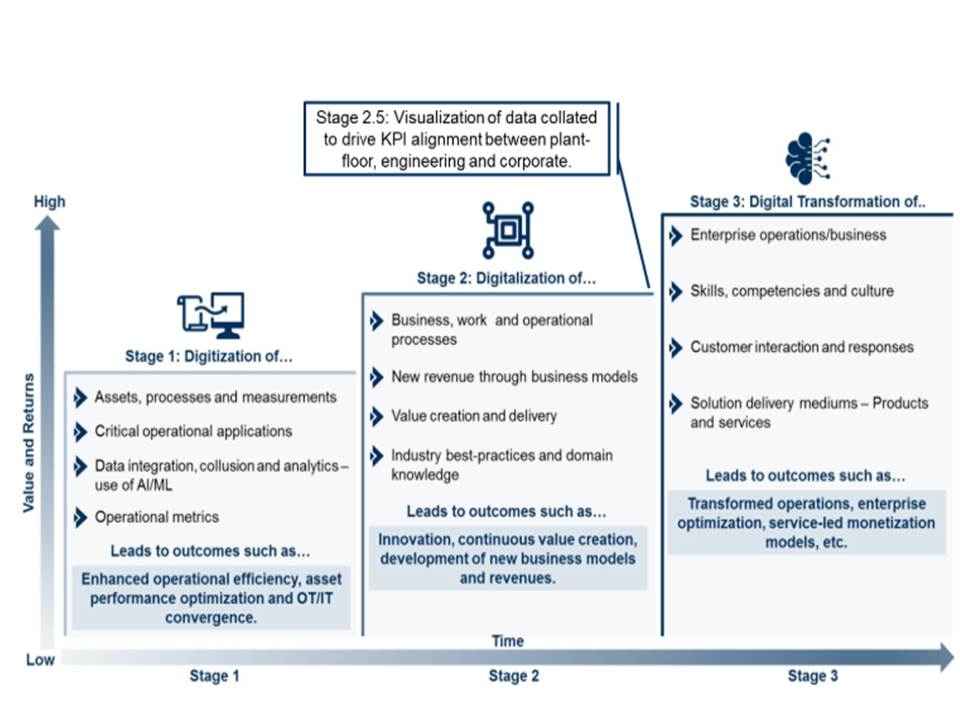

While the value-drivers to go digital for industries, vary by type – it is important to realize the underlying commonalities. As you see in the picture below, most industrial markets have been sensing parameters (pressure, temperature, level, flow, etc.) for over 30 years. Essentially, part of Stage 1 has always been done.

However, very few enterprises can claim that they take full action on the data collected. We estimate that across the energy value-chain – less than 5 percent of the data is captured to drive meaningful action. Unfortunately, the industry is data rich, but information poor. This brings us to a question that we asked end-users: What outcomes would you like to achieve with digital? Predominantly – the answers have been focused on reducing unplanned outages, minimizing the number of scheduled repairs, driving yield, production throughput and worker productivity. As you see – the majority of the focus is on the low hanging fruit: Predictive asset performance management. It is at this juncture that the beauty of IIoT and digital comes into play.

The convergence of sensing, algorithms, computing, and cloud is poised to drive a creative destruction and expansion of traditional business models. Before we talk about what impact this trend will have on industrial markets, let’s view the automotive market for instance. I have provided a few use-cases to help you understand the shift. This will also help you to understand when I talk about a similar trend on industrial markets:

For long – we have all bought and sold cars. Just remember, how painful the buying process was. I still recall haggling with the finance and trying to push back on extended service contracts that it left a very bad taste. The experience of buying a new car is very unpleasant. Why? It is clunky, process heavy, time-consuming, complex, etc. Car companies realized this and brought about a new way to buy cars. Shown below are some use-cases that I read in Tien Tzuo’s ‘Subscribed’ (If you have not read this book, strongly recommend reading it) and a few more I analyzed on my own:

Use case 1: Cadillac – Pay $1,800/month. Switch out vehicles 18 times /Y.

Use case 2: Volvo XC40 – Pay $600/month. The fee/month covers the basic needs namely – insurance, roadside assistance, repairs and scheduled maintenance. I believe you can sign up for 2Y.

Use case 3: Hyundai Ioniq – $275/month. The base price and then they have tiered pricing models ($305/month for Limited and $365/month for Limited Ultimate). The features vary by subscription package.

Use case 4: Porsche – Launched its passport service at $2,000/month. Gives you access to eight vehicles in its lineup ( Boxster, Cayman S, Cayenne and Macan S). If you want access to all 22 models, then the price goes up to $3,000/month.

There are two main takeaways from the above user cases.

- The aspect of owning an asset is shifting to subscribing to an asset. Today, I still like to own my cars – but as time progresses, I might change my mind.

- I really like the aspect of all needs bundled into one neat price package. Simple, effective, and clean. Secondly, I also like the tiered model of pricing. Makes me think – is it worth the experience? If I do subscribe a higher-level service, then the companies go to great extents to make you feel privileged. As Maya Angelou famously said, “At the end of the day people won’t remember what you said or did, they will remember how you made them feel.” You leave, remembering the experience. It is the experience that counts.

Agreed? Now let’s quickly shift gears to industrial markets. Process industries are stapled with rotating assets like mills, pumps and large assets like naphtha crackers, etc. Can the subscriber model be applied to asset heavy industries? Based on what we see in the market – the answer is a resounding yes. Cutting to the chase on why end-users are willing to subscribe to an asset instead of owning the assets:

- Enterprises core business is not in managing assets but in fulfilling commitments. Be it in refining or chemicals industry, the core business is in producing more distillates and ethane/ethylene and not in the upkeep of the assets that help them produce more.

- Shrink in workforce onsite. Experienced workforce is retiring and millennials are entering the workforce that is not very familiar with process intricacies.

Clearly, the trend is not an immediate switch. The shift is progressive and customers are also very judicious about this. They are not throwing money on subscriptions, which is in line with the culture of industrial markets. However, they are open to this model and willing to adopt in areas of criticality. Taking the thread from automotive, the pricing models for assets vary widely from as low as $5/asset/month to as high as $7,500/asset/month. For assets such as turbines – the pricing would be even higher. In essence, customers are moving in two directions:

- Own the asset, but subscribe to performance services.

- Simply subscribe to the asset as a whole (not owned), with packaged/tiered service.

While there are many companies promoting this subscriber model across industries, not many will turn successful. This is due to the reason that, not everyone can promise an outcome of an asset. You need process expertise, domain knowledge, asset models, co-relation knowledge, etc. I don’t prefer to single out a specific company, but a major automation solutions company are breaking barriers here and pushing the envelope to drive transformative change. As industries make the transition from selling products to selling performance, subscribers/members (as Tien says) will bring in a whole lot of competitive differentiation.

Disruption by digital is inevitable. How you choose to play and sustain winning is really up to you!

![]() This article was written by Muthuraman “Ram” Ramasamy, Industry Director, Frost & Sullivan.

This article was written by Muthuraman “Ram” Ramasamy, Industry Director, Frost & Sullivan.