For all the pain that 2020 brought on societies and economies around the world, it also brought some positives. Chief among them was the increased awareness for all of us to prioritize climate change and net-zero sustainability efforts.

In their ‘next normal’ trend analysis, McKinsey & Company reported that “All over the world, the costs of pollution—and the benefits of environmental sustainability—are increasingly recognized … Many (though by no means all) countries are using their recovery plans to push through existing environmental policy priorities … The imperative for businesses is clear along two fronts. First, businesses need to respond to the sustainability concerns of investors … [Secondly] the growth opportunities that a green economy portends could be substantial.”

Sustainable practices help protect the world and your business

Sustainability has gone mainstream. In the U.S. in 2020, 90% of companies in the S&P 500 index reported on their sustainability progress, whereas just around 20% did so in 2011. COVID-19 has fueled the sustainable financing trend, with 85% of institutional investors today seeking environmental, social, and governance (ESG)-oriented hedge funds. Mainstream investors increasingly believe that ESG metrics have a direct impact on risk and return. There is strong evidence that sustainable performance is consistent with equal or better returns for investors.

BlackRock CEO Larry Fink said that climate change will be “a defining factor in companies’ long-term prospects.” Since the pandemic, the emphasis on climate change has taken on greater focus within companies and among investors, who piled into the stocks of sustainable companies en masse. More recently, Fink is asking CEOs “to disclose a plan for how their business model will be compatible with a net-zero [carbon] economy.”

Beyond impacting stock valuation, ESG-related legislation is on the rise on a global scale, including in the U.S. Individual states have also been introducing climate-related legislation; for example, New York’s LL97 and California’s carbon reduction legislation. Companies that do not start benchmarking their energy use to comply with new regulations will risk fines. But legislation can’t succeed on its own – all companies need to take action to be part of the climate change solution.

The net-zero transition

Here are a few questions to consider:

- Has your company felt sustainable finance pressures from your investors?

- How much has ESG impacted your strategy?

- Have you aligned financial reporting with ESG reporting?

- Have you conducted a materiality analysis to understand ESG factors driving the most value for your organization?

- How is ESG connected with your organization’s risk management efforts?

- How familiar are you with Task Force on Climate-related Financial Disclosures (TCFD)?

- How are you tracking regulatory changes?

Ultimately, meeting sustainability goals will satisfy investors and help bolster asset value. However, pursuing such objectives does not mean compromising overall business and financial success. In fact, making companies more sustainable helps drive greater efficiency which, in turn, drives greater profitability. For example, the U.S. Green Building Council cites reports that indicate green buildings have almost 20 percent lower maintenance costs, green retrofits lower annual operating costs by 10 percent, and tenants are often willing to pay higher rents for LEED-certified space, making decarbonization of buildings a priority.

Demonstrating sustainability success and reaching farther

We as a company have been on a sustainability journey for 15 years, renewing our sustainability programs and targets every three to five years. Our Schneider Sustainable Impact program spanned 2018-2020 and exceeded our target goals. Achievements included saving over 130 million tons of CO2 emissions, increasing the use of renewable electricity from 2% to 80%, and much more.

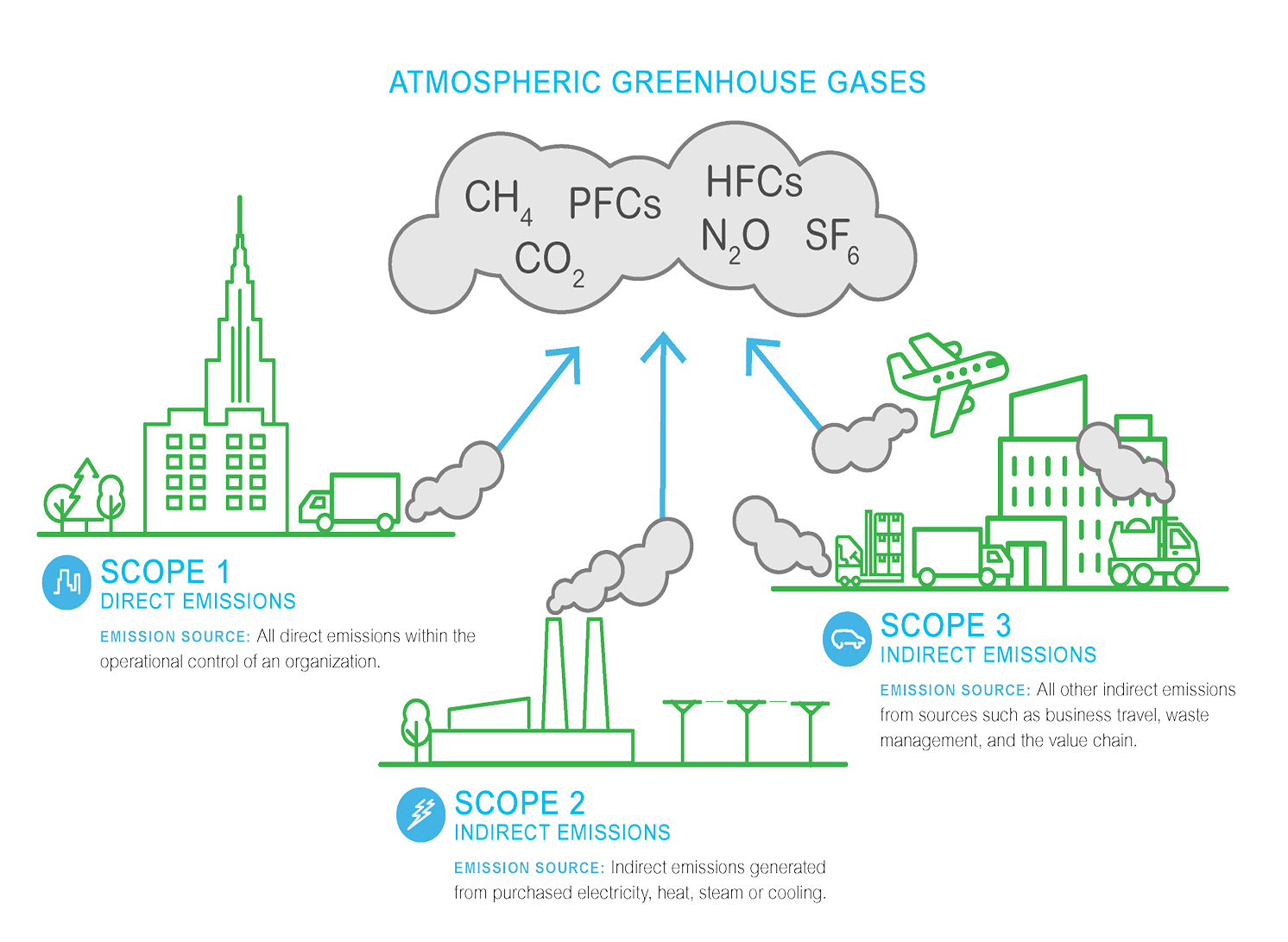

While the sustainability plans of many large organizations are limited to focusing only on Scope 1 and 2 type emissions – e.g., company facilities, vehicles, and purchased energy – we are including Scope 3 activities in our long-term strategy.

It includes upstream and downstream emissions that are part of our extended value chain of operations. For many companies, this can represent the biggest percentage of greenhouse gas (GHG) impacts and, therefore, the biggest opportunities for reduction.

For example, we’ve just launched an initiative to help our top 1,000 suppliers – which represent 70% of our carbon emissions – to halve their CO2 emissions by 2025, using digital tools that enable data-driven decisions. Similarly, we are helping our customers with Stage 3 initiatives, including our collaboration with Walmart that will provide “increased access to renewable energy for their U.S.-based suppliers, enabling them to lead on climate action.”

Four steps to reache net-zero sustainability success

As a global sustainability leader, we’ve accelerated our own net-zero (carbon neutrality) goal by five years to a 2025 target, and we’ve also helped thousands of companies on their own decarbonization journeys. Our decades of experience and expertise have formed the development of a proven, holistic strategy based on a four-stage roadmap that can help your organization define, set, deploy, and sustain its decarbonization program. Here is a summary of this four-stage decarbonization pathway:

1. Define success

Use market research to help you understand the competitive landscape and opportunities. Benchmark all emissions by source across all your sites. Engage stakeholders, map your journey, and align with your business commitments. Use digital solutions including our EcoStruxure best-in-class software and services to support decision-making.

2. Set targets

Analyze risks and opportunities for decarbonization, then set ambitious and achievable goals. Develop and map programs by identifying and validating target scenarios, KPIs, and funding opportunities. Partner to help publicize targets and validate and report on progress through leading indices.

3. Deploy programs

Gain support in procuring, managing, and balancing your energy and carbon portfolios. Choose from energy performance contracting, enterprise efficiency software and services, and connected monitoring technologies. Replace carbon-intensive energy with lower-carbon alternatives (e.g., renewable energy, combine-heat-and-power, microgrid and Energy-as-a-Service, and more). Balance unavoidable emissions that cannot be reduced (e.g., carbon offsets). Launch supply and value chain initiatives.

4. Sustain results

Use performance tracking and analytics to support optimal decisions. Track the performance of renewable and cleantech assets. Use reporting, marketing, and communications to help engage with stakeholders and amplify success.

For more information, download our paper “Decarbonization Now: A Holistic Approach to Organizational Climate Action.”

Originally this article, written by Jana Gerber & Khaled Fakhuri, was published here.